AML/CFT Red Flags – Banks (1)

Transactions Which Do Not Make Economic Sense

- A customer relationship with the direct life insurer that does not appear to make economic sense, for example, the early redemption of a policy when the surrender value is less than the value of premiums paid.

- Transactions in which policies are cancelled shortly after premiums have been paid, resulting in the return of premiums, unless the direct life insurer is furnished with a plausible reason for the cancellation, especially where policy premiums have been paid in cash.

- Transactions that are incompatible with the normal activities of the customer, for example, taking out a policy loan soon after the inception of the policy. In addition, if an existing customer whose current contracts are small or involve only small, regular premium payments makes a sudden request for a purchase of a significantly large single premium policy, this may also prompt further investigations by the direct life insurer.

- Transactions that are not commensurate with the customer’s apparent financial means, for example, where customers without reasonable financial standing purchase large single premium policies for a large assured sum.

- Transactions where the nature, size or frequency appears unusual, for example, a customer requests transactions involving multiple policies of a similar nature, which aggregate to large amounts. In addition, a customer’s request for the early termination of a single premium policy especially when cash had been tendered should also prompt further investigations by the direct life insurer.

- Transactions in which funds are received by way of a third party cheque, especially where there is no apparent connection between the third party and the customer. Abnormal settlement instructions, including payment to apparently unconnected parties.

Transactions Involving Large Sums

- Payment of premiums via large or unusual amounts of cash. In particular, a direct life insurer should be vigilant in verifying information and the nature of transactions of any customer if any large single payment is made in cash.

- Frequent taking out of policy loans that are repaid with large amounts of cash.

- Transactions in which funds are received from or paid to a customer’s account in a financial haven, or in foreign currency especially when such transactions are not consistent with the customer’s transaction history.

- Overpayment of premium with a request to refund the excess to a third party or an account held in a different country or jurisdiction.

Transactions Involving Transfers Abroad

- Large and regular premium payments that cannot be clearly identified as bona fide transactions, from countries or jurisdictions associated with (a) the production, processing or marketing of narcotics or other illegal drugs or (b) other criminal conduct.

- Substantial increase in cash premium payments from foreign countries or jurisdictions by a customer without apparent cause, especially when such transactions are not consistent with the customer’s transaction history.

Direct Life Insurers – AML/CFT Red Flags

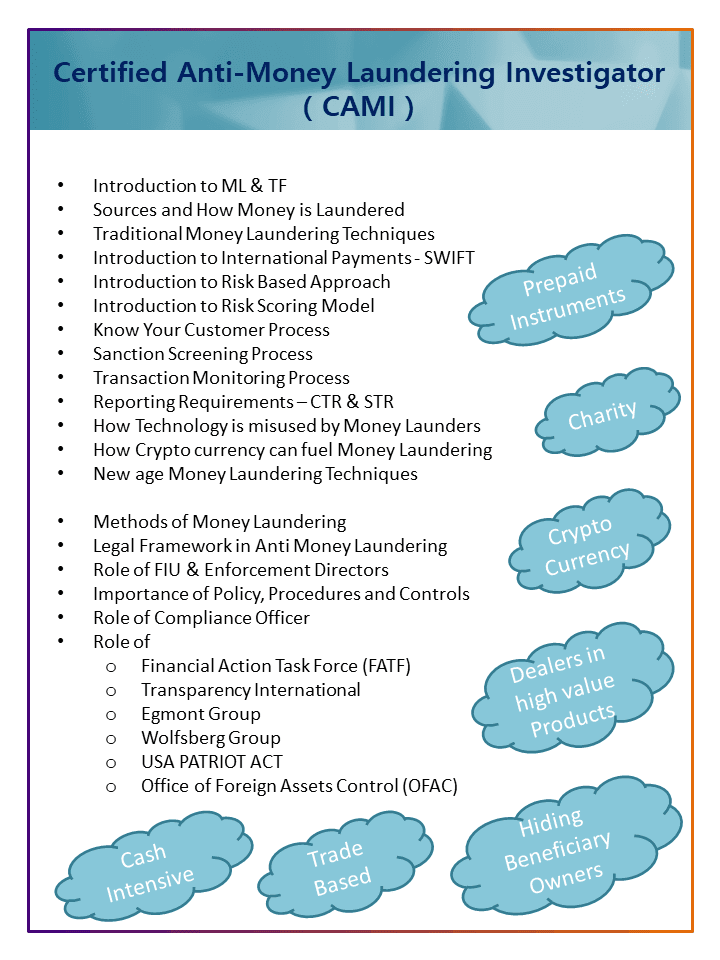

Certified Anti Money Laundering Investigator (CAMI) is an International AML training program to your upskill knowledge & crack interviews in the compliance industry.

Training Agenda:

FATF 40 recommendations

USA PATRIOT ACT

International AML Policy & Procedures

Advanced AML Investigation Techniques

Mode of training: Live online training

Fees: 500 USD