Elements To Prove Money Laundering Case (1/2)

Elements To Prove Money Laundering Case (1/2)

1. The defendant was aware that the money involved was derived from a fraud

One should be aware that they were ‘laundering’ money came from a criminal action to be named a criminal. Otherwise, you have not done money laundering if you “laundered” money that you did not suspect derived from the commission of a crime. However, keep in mind that the prosecutor’s burden of evidence is comparatively low. They need to prove that you were aware that it was obtained unlawfully in some manner – not that you know where it came from. They can prove this with circumstantial proof.

2. A financial activity must have been started or completed by the defendant

A purchasing, donation, transfer, loan, loan, withdrawal, exchange of money, an extension of credit, purchase or sale of a safe-deposit box, the transaction between accounts, or any other form of payment, transfer, or distribution to, by, or through a financial entity is legally classified as a “financial transaction.” The prosecutor must show that you were involved in the beginning or end of one of these transfers.

3. The defendant took place in one of the following steps of money laundering

To accuse anyone of money laundering, the court must show that the suspect did participate in the following three phases of money laundering:

- Transfer: The suspect must have placed a large amount of money of unlawfully acquired funds in a financial company. Federal law establishes the maximum amount of cash that can be deposited without triggering suspicion of money laundering. If the institution has noted that the consumer owns a cash-rich company such as a restaurant, a cash transfer of more than $10,000 will raise a red flag.

- Layering: Once the suspected suspicious money has cleared in a financial institution, the suspect may have participated in misleading financial practices to make the income appear to be part of his or her regular business activities. A prosecution can provide evidence in the form of a set of wire transfers to various companies in and out of the country.

- Implementation: The convict must have taken the money back into the local economy identified as legal fee after numerous transactions had processed purportedly illegal cash.

https://sanctionscanner.com/blog/three-elements-that-must-be-proven-in-a-money-laundering-case-409

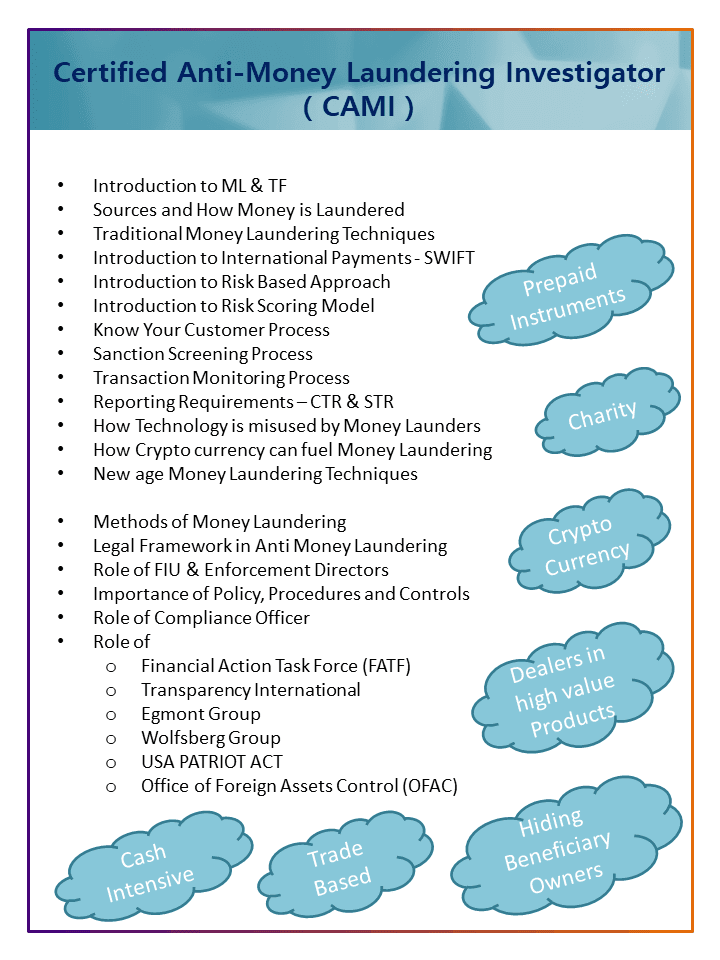

Certified Anti Money Laundering Investigator (CAMI) is an International AML training program to your upskill knowledge & crack interviews in the compliance industry.

Training Agenda:

FATF 40 recommendations

USA PATRIOT ACT

International AML Policy & Procedures

Advanced AML Investigation Techniques

Mode of training: Live online training

Fees: 500 USD