FATF: Trade Based Money Laundering Risk Indicators (TBML) – 1/3

A risk indicator demonstrates or suggests the likelihood of the occurrence of unusual or suspicious activity, it could prompt further monitoring and examination.

Some of the risk indicators require the cross-comparison of various data elements (e.g. financial transactions, customs data, and open market prices) often held in external sources.

- The corporate structure of a trade entity appears unusually complex and illogical, such as the involvement of shell companies or companies registered in high-risk jurisdictions.

- A trade entity is registered or has offices in a jurisdiction with weak AML/CFT compliance.

- A trade entity is registered at an address that is likely to be a mass registration address, e.g. high-density residential buildings, post-box addresses, commercial buildings or industrial complexes, especially when there is no reference to a specific unit. This may also include the address of a trust and company service provider that manages a number of shell companies on behalf of its customers.

- The business activity of a trade entity does not appear to be appropriate for the stated address, e.g. a trade entity appears to use residential properties, without having a commercial or industrial space, with no reasonable explanation.

- A trade entity lacks an online presence or the online presence suggests business activity inconsistent with the stated line of business, e.g. the website of a trade entity contains mainly boilerplate material taken from other websites or the website indicates a lack of knowledge regarding the particular product or industry in which the entity is trading.

- A trade entity displays a notable lack of typical business activities, e.g. it lacks regular payroll transactions in line with the number of stated employees, transactions relating to operating costs, tax remittances.

- Owners or senior managers of a trade entity appear to be nominees acting to conceal the actual beneficial owners, e.g. they lack experience in business management or lack knowledge of transaction details, or they manage multiple companies.

- A trade entity, or its owners or senior managers, appear in negative news, e.g. past money laundering schemes, fraud, tax evasion, other criminal activities, or ongoing or past investigations or convictions.

- A trade entity maintains a minimal number of working staff, inconsistent with its volume of traded commodities.

- The name of a trade entity appears to be a copy of the name of a well-known corporation or is very similar to it, potentially in an effort to appear as part of the corporation, even though it is not actually connected to it.

- Payments are routed in a circle – funds are sent out from one country and received back in the same country, after passing through another country or countries.

https://www.fatf-gafi.org/media/fatf/content/images/Trade-Based-Money-Laundering-Risk-Indicators.pdf

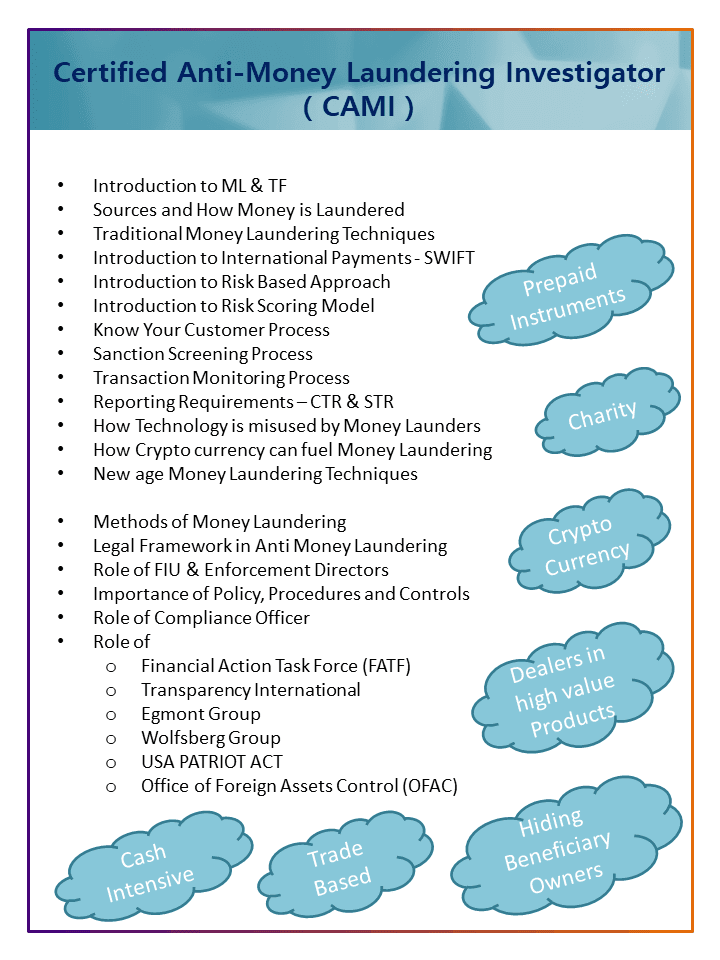

Certified Anti Money Laundering Investigator (CAMI) is an International AML training program to your upskill knowledge & crack interviews in the compliance industry.

Training Agenda:

FATF 40 recommendations

USA PATRIOT ACT

International AML Policy & Procedures

Advanced AML Investigation Techniques

Mode of training: Live online training

Fees: 500 USD