FATF: Trade Based Money Laundering Risk Indicators (TBML) – 3/3

A risk indicator demonstrates or suggests the likelihood of the occurrence of unusual or suspicious activity, it could prompt further monitoring and examination.

Some of the risk indicators require the cross-comparison of various data elements (e.g. financial transactions, customs data, and open market prices) often held in external sources.

- Contracts, invoices, or other trade documents display fees or prices that do not seem to be in line with commercial considerations, are inconsistent with market value, or significantly fluctuate from previous comparable transactions.

- Contracts, invoices, or other trade documents have vague descriptions of the traded commodities, e.g. the subject of the contract is only described generically or non-specifically.

- Trade or customs documents supporting the transaction are missing, appear to be counterfeits, include false or misleading information, are a resubmission of previously rejected documents, or are frequently modified or amended.

- Contracts supporting complex or regular trade transactions appear to be unusually simple, e.g. they follow a “sample contract” structure available on the Internet.

- The value of registered imports of an entity displays significant mismatches to the entity’s volume of foreign bank transfers for imports. Conversely, the value of registered exports shows a significant mismatch with incoming foreign bank transfers.

- Commodities imported into a country within the framework of temporary importation and inward processing regime are subsequently exported with falsified documents.

Shipments of commodities are routed through a number of jurisdictions without economic or commercial justification. - A trade entity makes very late changes to payment arrangements for the transaction, e.g. the entity redirects payment to a previously unknown entity at the very last moment, or the entity requests changes to the scheduled payment date or payment amount.

- An account displays an unexpectedly high number or value of transactions that are inconsistent with the stated business activity of the client.

- An account of a trade entity appears to be a “pay-through” or “transit” account with a rapid movement of high-volume transactions and a small end-of-day balance without clear business reasons, including: ‒ An account displays frequent deposits in cash which are subsequently transferred to persons or entities in free trade zones or offshore jurisdictions without a business relationship to the account holder. ‒ Incoming wire transfers to a trade-related account are split and forwarded to nonrelated multiple accounts that have little or no connection to commercial activity.

- Payment for imported commodities is made by an entity other than the consignee of the commodities with no clear economic reasons, e.g. by a shell or front company not involved in the trade transaction.

- Cash deposits or other transactions of a trade entity are consistently just below relevant reporting thresholds.

- Transaction activity associated with a trade entity increases in volume quickly and significantly, and then goes dormant after a short period of time.

https://www.fatf-gafi.org/media/fatf/content/images/Trade-Based-Money-Laundering-Risk-Indicators.pdf

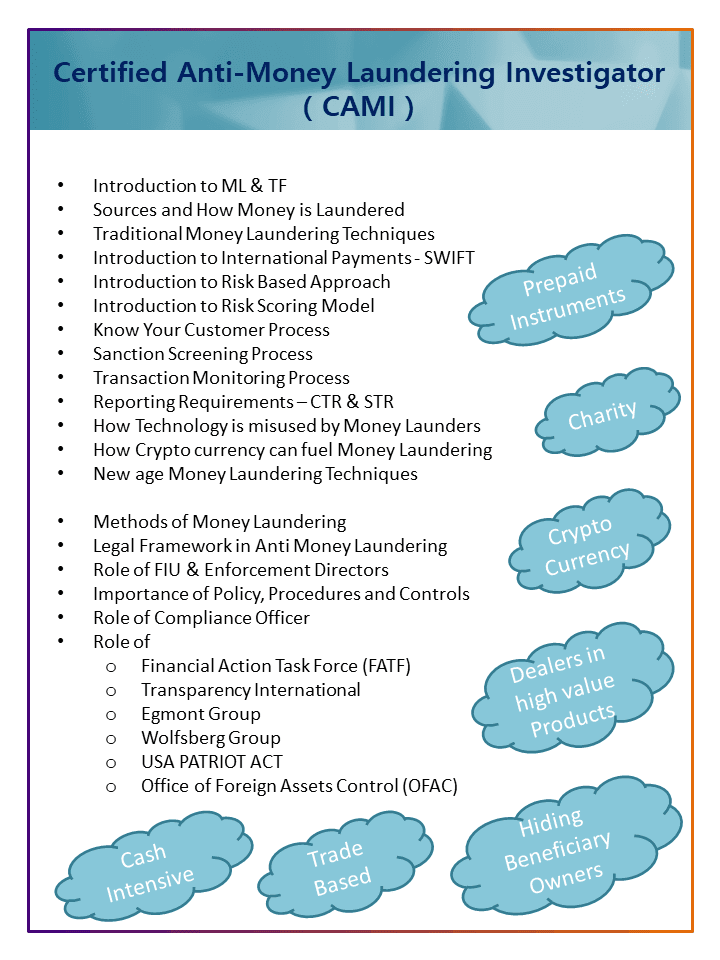

Certified Anti Money Laundering Investigator (CAMI) is an International AML training program to your upskill knowledge & crack interviews in the compliance industry.

Training Agenda:

FATF 40 recommendations

USA PATRIOT ACT

International AML Policy & Procedures

Advanced AML Investigation Techniques

Mode of training: Live online training

Fees: 500 USD