Sanctions are easier than ever for Russians to evade. Thank to Bitcoin

The West’s initial salvo of financial sanctions against Russia failed to deter President Vladimir Putin from launching a full-scale invasion of Ukraine. Now the United States is taking a punitive approach, announcing another round of sanctions meant to tighten the screws on Russian banks and “corrupt billionaires.”

But some experts say those measures, which so far do not target Putin himself, are becoming increasingly easy to evade, thanks in part to a surge of cryptocurrency adoption in Russia.

The US and EU sanctions rely heavily on banks to enforce the rules. If a sanctioned business or individual wants to make a transaction denominated in traditional currencies such as dollars or euros, it’s the bank’s responsibility to flag and block those transactions.

But digital currencies operate outside the realm of standard global banking, with transactions recorded on a public ledger known as the blockchain.

“If the Russians decide — and they’re already doing this, I’m sure — to avoid using any currency other than cryptocurrency, they can effectively avoid virtually all of the sanctions,” said Ross S. Delston, an expert on anti-money laundering compliance.

The US Treasury is well aware of this problem. In an October report, officials warned that digital currencies “potentially reduce the efficacy of American sanctions” by allowing bad actors to hold and transfer funds outside the traditional financial system. “We are mindful of the risk that, if left unchecked, these digital assets and payments systems could harm the efficacy of our sanctions.”

As Exhibit A, look no further than Eastern Europe, which has one of the highest rates of crypto transaction volume associated with criminal activity, according to research by Chainalysis. Websites used for illicit trades known as darknet markets brought in a record $1.7 billion worth of cryptocurrency in 2020, most of it in Bitcoin.

And nearly all of the growth in darknet market that year can be attributed to one specific Russian-language-only market called Hydra. Hydra is “by far the largest darknet market in the world, accounting for over 75% of darknet market revenue worldwide in 2020,” Chainalysis wrote in a report earlier this month.

Of course, evading sanctions isn’t as easy as dumping all your dollar-denominated funds into Bitcoin. It’s hard to buy anything with crypto, especially big stuff, Delston says.

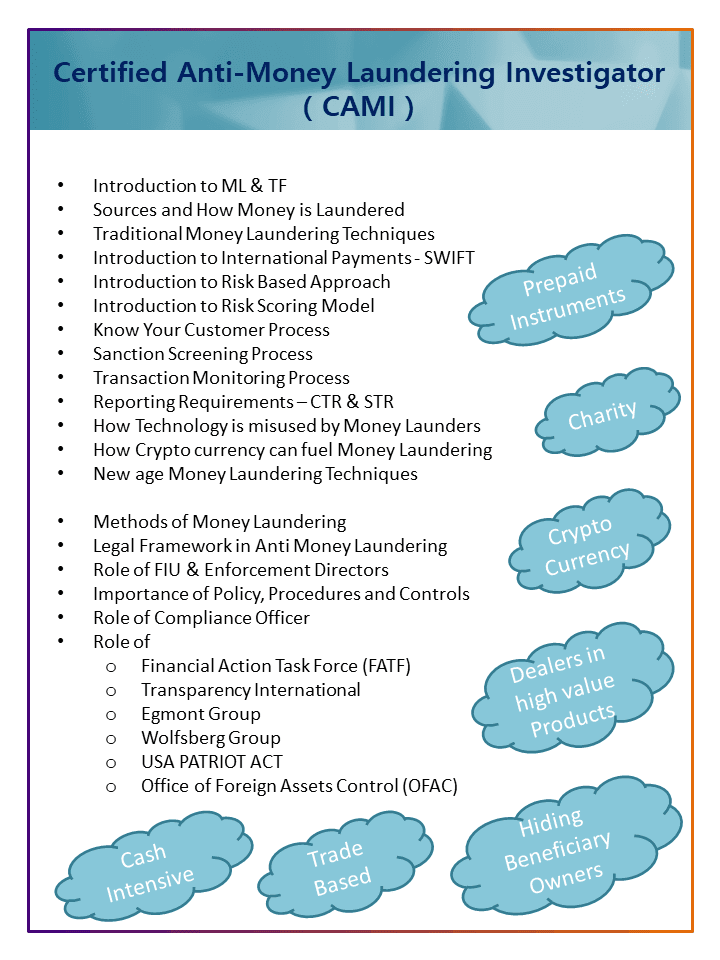

https://edition.cnn.com/2022/02/24/business/cryptocurrency-bitcoin-russia-sanctions/index.htmlCertified Anti Money Laundering Investigator (CAMI) is an International AML training program to your upskill knowledge & crack interviews in the compliance industry.

Training Agenda:

FATF 40 recommendations

USA PATRIOT ACT

International AML Policy & Procedures

Advanced AML Investigation Techniques

Mode of training: Live online training

Fees: 500 USD