FATF: Trade Based Money Laundering Risk Indicators (TBML) – 2/3

A risk indicator demonstrates or suggests the likelihood of the occurrence of unusual or suspicious activity, it could prompt further monitoring and examination.

Some of the risk indicators require the cross-comparison of various data elements (e.g. financial transactions, customs data, and open market prices) often held in external sources.

- A trade entity has unexplained periods of dormancy.

- An entity is not compliant with regular business obligations, such as filing VAT returns.

- Trade activity is inconsistent with the stated line of business of the entities involved, e.g., a car dealer is exporting clothing or a precious metals dealer is importing seafood.

- A trade entity engages in complex trade deals involving numerous third-party intermediaries in incongruent lines of business.

- A trade entity engages in transactions and shipping routes or methods that are inconsistent with standard business practices.

- A trade entity makes unconventional or overly complex use of financial products, e.g. use of letters of credit for unusually long or frequently extended periods without any apparent reason, intermingling of different types of trade finance products for different segments of trade transactions.

- A trade entity consistently displays unreasonably low profit margins.5 in its trade transactions, e.g. importing wholesale commodities at or above retail value, or reselling commodities at the same or below purchase price.

- A trade entity purchases commodities, allegedly on its own account, but the purchases clearly exceed the economic capabilities of the entity, e.g. the transactions are financed through sudden influxes of cash deposits or third-party transfers to the entity’s accounts.

- A newly formed or recently re-activated trade entity engages in high-volume and highvalue trade activity, e.g. an unknown entity suddenly appears and engages in trade activities in sectors with high barriers to market entry

- Inconsistencies across contracts, invoices or other trade documents, e.g. contradictions between the name of the exporting entity and the name of the recipient of the payment; differing prices on invoices and underlying contracts; or discrepancies between the quantity, quality, volume, or value of the actual commodities and their descriptions.

- Payments are sent or received in large round amounts for trade in sectors where this is deemed as unusual.

https://www.fatf-gafi.org/media/fatf/content/images/Trade-Based-Money-Laundering-Risk-Indicators.pdf

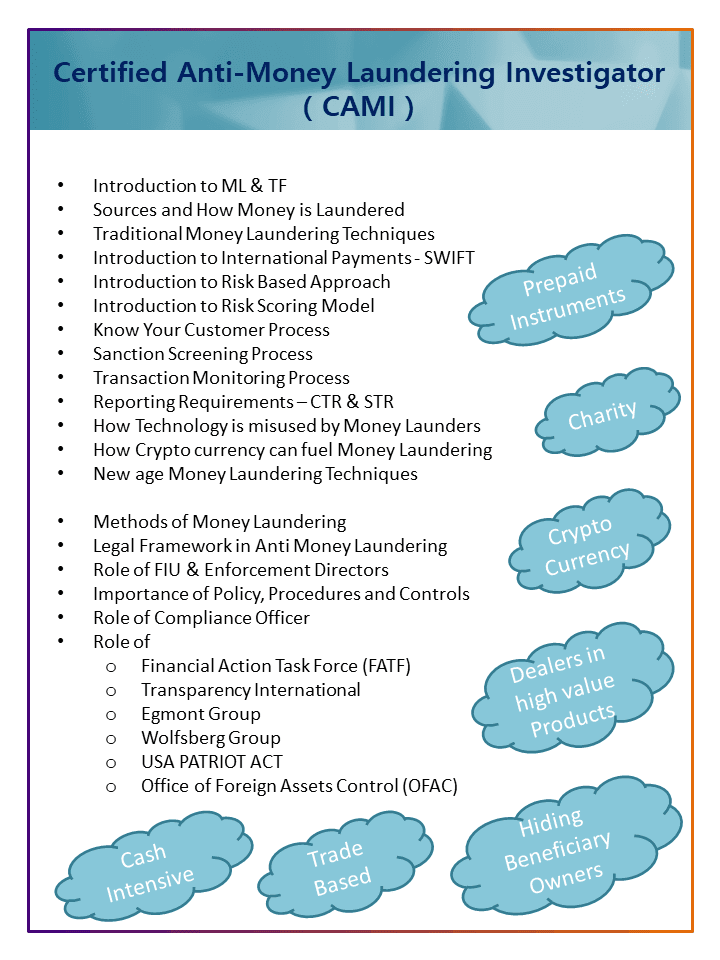

Certified Anti Money Laundering Investigator (CAMI) is an International AML training program to your upskill knowledge & crack interviews in the compliance industry.

Training Agenda:

FATF 40 recommendations

USA PATRIOT ACT

International AML Policy & Procedures

Advanced AML Investigation Techniques

Mode of training: Live online training

Fees: 500 USD